Alain Glanzman found that whenever he lost a credit card, not only did he have to deal with the normal logistical issues of having it replaced, but he also had to update his subscription services, his Uber and Lyft payments, and other automatic charges linked to that card.

CEO Glanzman and COO Marc Miller founded Durham-based WalletFi to help solve this issue with tracking subscriptions — after all, the subscription economy (Netflix, Spotify, etc.) has grown 3,000 percent in just the past five years according to the company’s website. Consumers also link their card to services such as Venmo or to pay for all sorts of recurring charges like rent and utilities, especially if the cards offer reward points.

Glanzman was an MBA student at UNC-Chapel Hill’s Kenan-Flagler when he realized that there was a market need for auto-updating credit and debit card information with subscription services, but there wasn’t anyone providing that yet.

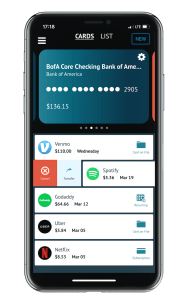

WalletFi offers a platform that tracks recurring charges, subscriptions, and card-on-file payments, and allows financial institutions to automatically transfer those payments to a new card when it’s reissued. The startup offers an API, which directly integrates with WalletFi’s recurring charge identification and subscription transfer technology. WalletFi also provides a white label offering, so financial institutions can use WalletFi’s technology within their own apps and empower its customers to proactively move their subscriptions and remain top-of-wallet.

WalletFi offers a platform that tracks recurring charges, subscriptions, and card-on-file payments, and allows financial institutions to automatically transfer those payments to a new card when it’s reissued. The startup offers an API, which directly integrates with WalletFi’s recurring charge identification and subscription transfer technology. WalletFi also provides a white label offering, so financial institutions can use WalletFi’s technology within their own apps and empower its customers to proactively move their subscriptions and remain top-of-wallet.

WalletFi reduces the hassle customers and financial institutions have to deal with when replacing a lost or stolen card — or, increasingly, one that has to be changed due to suspected fraud, identity theft, or data hacks — and updating their information, Glanzman said. WalletFi works directly with banks and financial institutions to help solve this problem, and recently signed an (unnamed) big fish as its first paying customer.

“From a consumer standpoint, if you ever have your card reissued by a bank, we’ll tell you everything that needs to updated,” Glanzman said. “That’s a problem for a lot of people. It’s too easy to forget to update their Netflix or other subscription services, and we’re helping to deal with that.”

The startup is based out of Durham’s American Underground, a campus home to over 250 startups and a diverse entrepreneurial scene. Glanzman said that WalletFi has raised over $500K from a mix of local angel investors, venture capitalists and strategic partners.

WalletFi will soon undergo another round of funding, but this time they’re seeking a $3 million seed round. Glanzman said they’re hoping to have the funding raised by the end of Quarter 1 in 2019.

Glanzman said the company is expanding into Boston but its headquarters remain in the Triangle. He said he’s thankful that he conceived the company at UNC, because a lot of his professors helped him with advice, and he was able to even raise funding from the Carolina Research Venture Fund, a UNC-Chapel Hill-based early stage investment fund.

Recently, WalletFi signed its first paid customer, an Atlanta-based financial institution that’s also a Fortune 500 company. Glanzman said the company is excited about its first customer — and a very large one at that — and hopes to keep growing in the future.